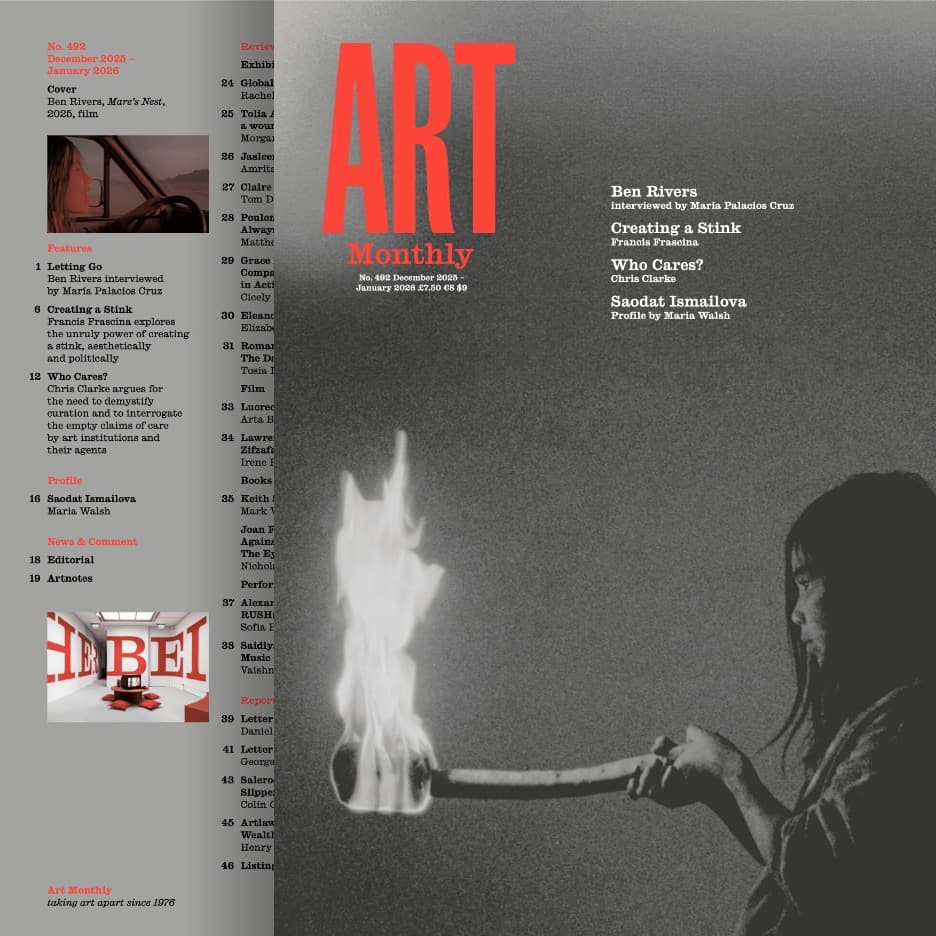

Art Monthly Magazine

Fiercely independent since 1976

Contents

Issue 492 December 2025

Ben Rivers, Mare's Nest, 2025

Interview

Letting Go

Ben Rivers interviewed by María Palacios Cruz

The young central character, Moon, she is on a kind of journey to understand the world and to figure out how to move forward which, to my mind, is like a gradual letting go of everything that's known.

Helen Chadwick urine casting in 1991

Feature

Creating a Stink

Francis Frascina explores the unruly power of creating a stink, aesthetically and politically

Alain Corbin traced the ways that stench was perceived and analysed in late-18th-century France, in contrast to the emphasis on deodorisation under modernity where the realities of foul odours are hidden and repressed in the denial of abjection.

Andrea Fraser, Little Frank and His Carp, 2001

Feature

Who Cares?

Chris Clarke argues for the need to demystify curation and to interrogate the empty claims of care by art institutions and their agents

There is seemingly no contradiction between the museum which, on the one hand, proudly declares its progressive agenda while, on the other, furloughs its workers, curtails hours and trims wages.

| | From the Back Catalogue

The New Curation

Mark Hutchinson argues that new approaches to curating offer merely the aestheticisation of politics. First published in 2004, now free online. |

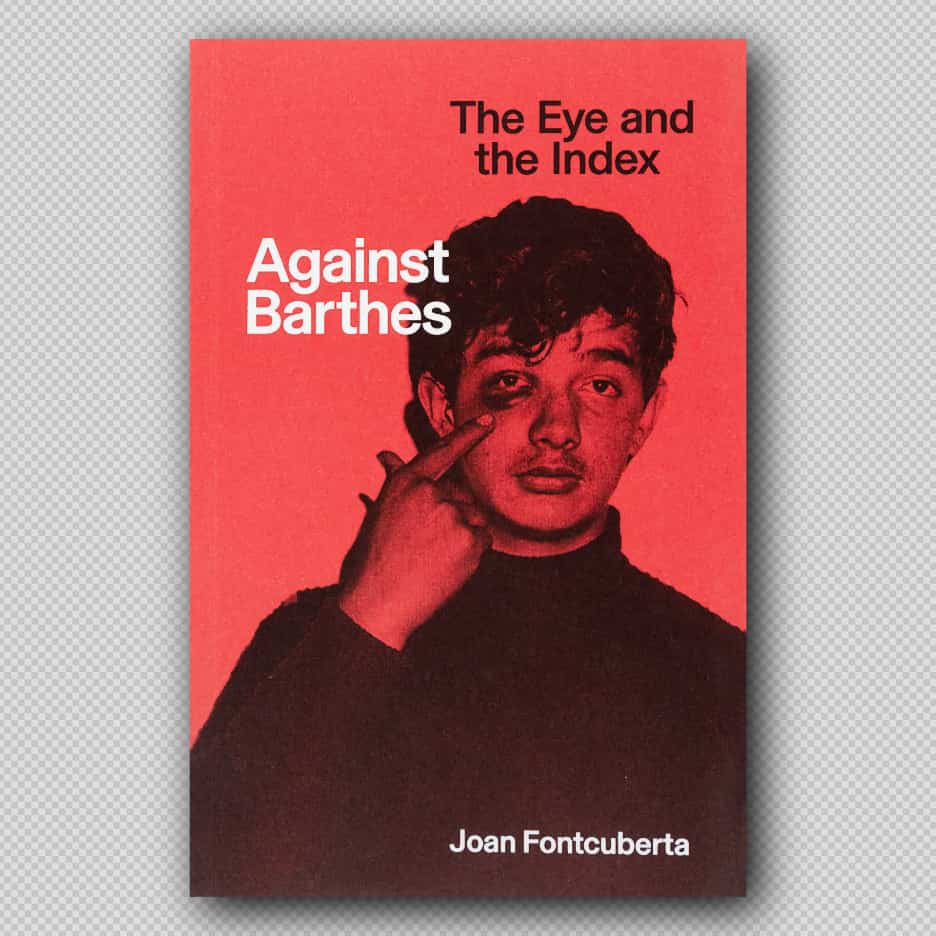

Saodat Ismailova, Melted Into the Sun, 2024

Profile

Saodat Ismailova

Maria Walsh

The film's main protagonist is based on Al-Muqanna (The Veiled One), an 8th‑century mystic and revolutionary in southern Central Asia, who challenged authoritarian centralised power, land‑extraction and religious repression, all pressing global social issues to this day.

sponsored

Editorial

One for the Money

Some artists may successfully play the art market by mimicking the conditions of Conceptual Art but such headline-grabbing transactions only underline the fundamental difference between such stunts and truly radical art.

In 1959 Yves Klein famously began selling 'zones' of empty space to collectors. In a ritualised transaction, buyers purchased a Zone of immaterial pictorial sensibility with a specified amount of pure gold. In return, they received a receipt which then had to be publicly burned in front of witnesses, after which Klein would toss half the gold into the river Seine, thereby returning it to nature.

sponsored

Artnotes

Good for You

A scientific experiment isolates the body's positive physical responses to original works of art; the government agrees to abandon the artless EBacc system in schools; galleries make carbon-cutting progress just as world leaders falter; Tate staff strike; plus the latest on galleries, people, awards and more.

Roman Ondak, Lucky Day, 2006, 'The Day After Yesterday', Kunsthalle Praha, Prague

Exhibitions

Global Fascisms

Haus der Kulturen Welt, Berlin

Rachel Pronger

Tolia Astakhishvili: a wound on my plate

Emalin, London

Morgan Quaintance

Jasleen Kaur: Boomerang

Hollybush Gardens, London

Amrita Dhallu

Claire Fontaine: Show Less

Mimosa House, London

Tom Denman

sponsored

Poulomi Basu: Always Coming Home

Focal Point Gallery, Southend

Matthew Bowman

Grace Ndiritu: Compassionate Rebels in Action

Cooper Gallery, Dundee

Cicely Farrer

Eleanor Antin: A Retrospective

Mudam, Luxembourg

Elizabeth Fullerton

Roman Ondak: The Day After Yesterday

Kunsthalle Praha, Prague

Tosia Leniarska

Lucrecia Martel, Landmarks, 2025

Film

Lucrecia Martel: Landmarks

Arta Barzanji

Here, Lucrecia Martel gives film a role it rarely assumes in cinema: not witness, not narrator, but evidence. The film circles the 2009 killing of Indigenous Argentine leader Javier Chocobar and the continuing dispute over land ownership. Rather than offering a single authoritative point of view, Martel assembles a heterogeneous archive and allows the frictions between the source material to generate meaning.

Lawrence Abu Hamdan, Zifzafa , 2024

Film

Lawrence Abu Hamdan: Zifzafa

Irene Revell

In this recent body of work, Lawrence Abu Hamdan is concerned with the way sounds are violently absented from a soundscape as much as he is with those that might be inflicted upon it.

Keith Sawyer, Learning to See

Books

Keith Sawyer: Learning to See

Mark Wilsher

Keith Sawyer's interpretation of art education is based on a close textual analysis of professors and students performing studio crits. Sawyer breaks down their exchanges into granular detail, pointing out the way that a syllable is stretched out, a sentence is left unfinished, a word is repeated. He calls this kind of language use 'studio talk' and, to him, each meandering sentence or pensive 'um' is a representation of the act of thinking on the spot.

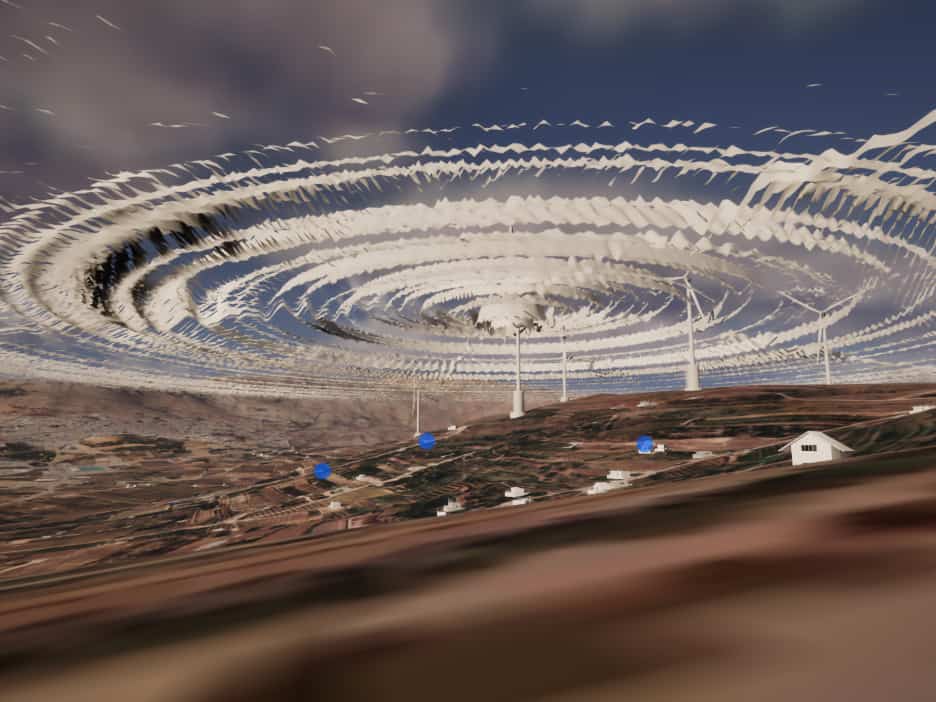

Joan Fontcuberta, Against Barthes

Books

Joan Fontcuberta: Against Barthes – The Eye and the Index

Nicholas Gamso

Joan Fontcuberta makes the point that in 'deepfakes' the image-text relation is reversed so that the photo follows from its caption: someone enters a prompt and AI spews out an image. Technically, the results aren't photographic, since they are made without a lens, a mirror, a darkroom. There is no index and nothing 'actual' about AI-generated imagery, though medial distinctions seem to matter less each day.

Alexandra Bachzetsis, RUSH(ES), 2025

Performance

Alexandra Bachzetsis: RUSH(ES)

Sofia Hallström

The choice of the Greek-Swiss artist Alexandra Bachzetsis to perform at the Hellenic Centre reads as a contemporary reflection on the ancient Greek understanding of orchestra, where the orchestris (female dancers) performed for elite male symposia; this work playfully pushes back at these boundaries.

Saidiya Hartman, Minor Music at the End of the World, 2025

Performance

Saidiya Hartman: Minor Music at the End of the World

Vaishna Surjid

It has always felt hard to pin down Saidiya Hartman. The American academic has long defied genres, troubling archives with her own, much celebrated method of critical fabulation. In this ambitious new multi-media performance, Hartman ask what the end of this world will look like.

Eva Fabregas, Exudates, 2025

Reports

Letter from Istanbul

Daniel Culpan

At a time of growing right-wing authoritarianism and the very real threat of censorship in the Turkish capital, symbol and allusion seem to be the modus operandi of this year's Biennial.

opening performance of the Kaunas Biennial by Rat Section

Reports

Letter from Kaunas

George MacBeth

It was refreshing to encounter an exhibition at this scale engaging with the work of living artists emerging from the same generational cohort and artistic network, instead of succumbing to that highly transmissible curatorial influenza largely describable as 'archive fever'.

Cindy Sherman, Untitled Film Still #13, 1978, estimate $500,000–700,000, sold for $2.27m

Salerooms

Slippery Sales

Colin Gleadell

While second-tier works by yesterday's superstars Jeff Koons, John Currin and Richard Prince sold below estimates, a classic 1980s Cindy Sherman 'Film Still' he had bought in 2000 for $167,000 sold for a double-estimate $2.3m.

French anti-austerity protests organised by the CGT union in support of an expanded wealth tax

Artlaw

Wealth Tax

Henry Lydiate

In 1975, artists wrote an open letter headed 'Wealth Tax and the Living Artist' warning that a proposed wealth tax, similar to the one France is currently proposing, would constitute an act of 'unbelievable imbecility' if it taxed artists on their 'stock' of unsold works.

Have Art Monthly delivered to your door

Read every issue ever published right now